The Evolution of Rewards: A Path to Decentralized Finance

In this piece, we explore how Gen Z can lead to the world’s adoption of DeFi and web3 through one simple but powerful feature that nearly every brand already uses. That feature? Rewards.

Why would decentralized finance be a future Gen Z wants?

Gen Z’ers are flocking away from banks and into Robinhood, fighting with stealth but power against corporate greed on platforms like Reddit and fueling what many call a financial revolution. And while the noise of the r/WallStreetBets uprising may have died down, the growth of those communities has not. Gen Z has seen that they can impact finance, that they have the power to sway, to disrupt, and to create change in a tangible, measurable way. And that knowledge can be dangerous.

But we believe at its core, this revolution is less about social inequalities as it is a revolution in trust. In a world of increasing access to information and to education, our generational circle of trust and true influence grows smaller. This is what we call the generational paradox of trust; with more sources to trust, we trust fewer. This we believe to hold true across nearly all facets of life for Gen Z - especially when dealing with money.

To Gen Z, the concept of digital currency exchanges is not novel. We grew up with gaming, playing in these virtual worlds like Minecraft, Club Penguin, and Webkinz, and exchanging our monthly allowances and our parents’ cash for in-app currencies. We grew up paying in-app to get a few extra plays or lives on Temple Run, Candy Crush, or Subway Surfers. We’ve always inherently understood and appreciated the transactional value of digital games. Do this to get this in a virtual setting. And that’s powerful and under-appreciated by many.

Yet brands are still chasing young consumers with tech jargon and an approach to these technologies through the perspective of Millennials or Gen X, not through the perspective of Gen Z. Gen Z wants to access, not own. We want influence, not responsibility. We don’t want the NFT, we want membership. The small nuances in the ways we communicate about the future will be the key to unraveling its adoption.

The evolution of Rewards programs plays beautifully into this generational need for access, influence, trust, and membership. Built as ways to reward loyal customers, Rewards programs have evolved into unique brand access points, membership statuses, and demonstrations of loyalty. But in order to see where they may evolve, we must take a look back at their history.

A most fascinating (and critical) history

In the late 1700s, merchants in the US started to give their customers copper tokens. Those tokens were redeemable in future purchases. This concept grew in popularity through the mid-1800s; it was a way to both attract customers and to get them to come back soon. But as copper became more expensive, merchants began using stamps.

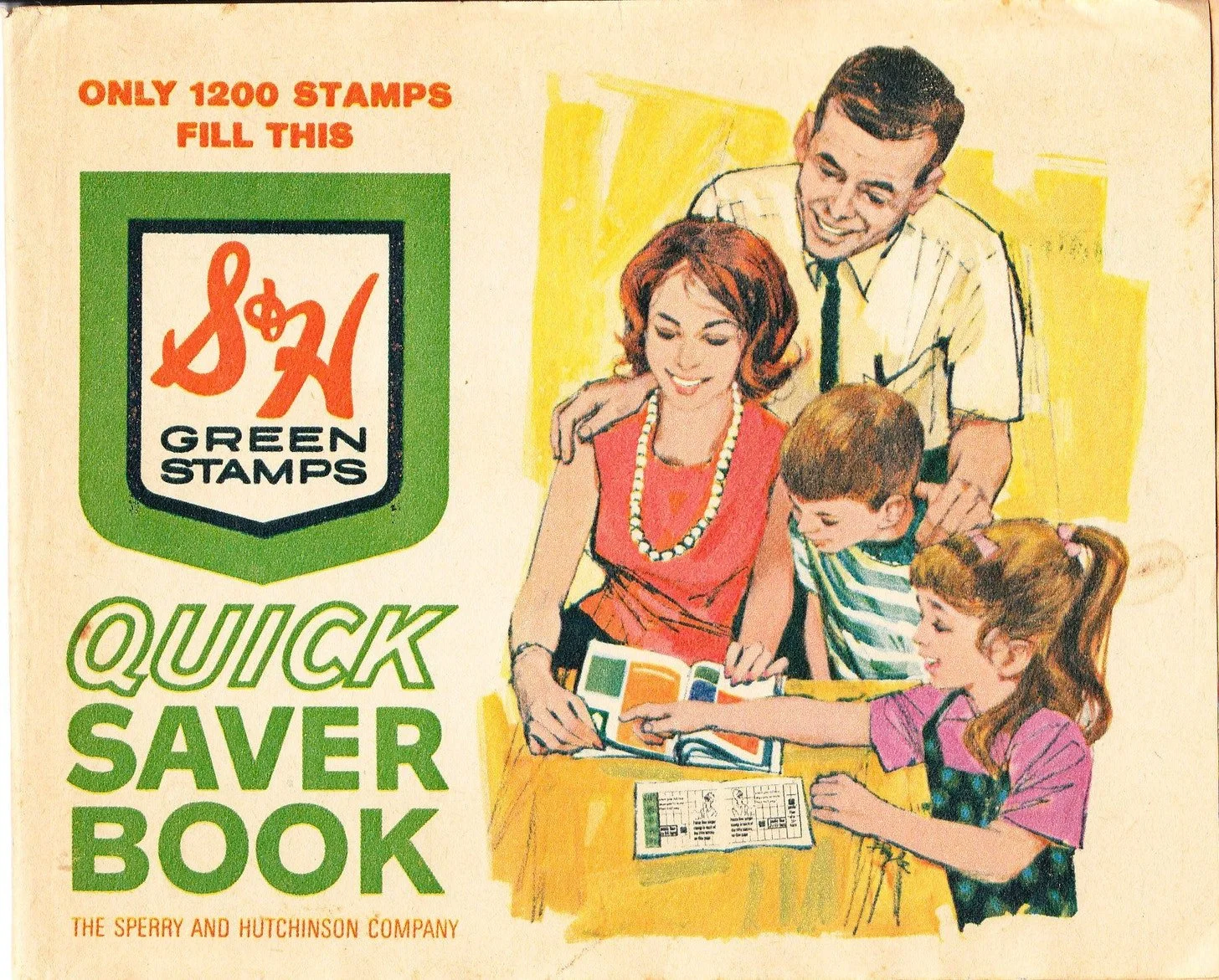

In 1896, the Sperry & Hutchinson company launched S&H Green Stamps as a way to offer rewards to their loyal customers. In supermarkets, gas stations, and stores, retail organizations bought stamps and gave them to customers based on the amount from a purchase. These stamps began to replace copper and quickly grew to become the most popular loyalty program in the world, issuing as many as 3x as many postal stamps as the US postal service (source).

As the 20th century moved on, a series of recessions in the 70s decreased the sales of stamps and the value plummeted, and fewer and fewer people began to see the value in these stamps.

In 1929, Betty Crocker had introduced the Box top, a cutout on cardboard that would be redeemed for free items. Boxtops began to climb in popularity, while other industries started to launch their own programs as well to reward their loyal customers.

In 1981 American Airlines launched AAdvantage, a massive innovation at the time providing new experiences to customers on board their flights. This concept quickly spread to hotels, hospitality, the car rental industry, and much more.

As the 90s came to a close, card-based programs began to grow too. Punch cards and membership cards were increasingly popular, with brands like Costco offering cards for membership fees.

This led us into the modern - or perhaps better said as the digital - stage of loyalty programs. The rise of web2.0 provided companies with an opportunity to reward customers through online ecosystems, both on computers and on mobile devices. Cards turned to emails turned to apps, as loyalty was targeted through a gamification of incentives and a manipulation of the mind, using notifications and triggers built into our daily habits to hardwire these “loyal” behaviors into our minds.

Modern rewards programs

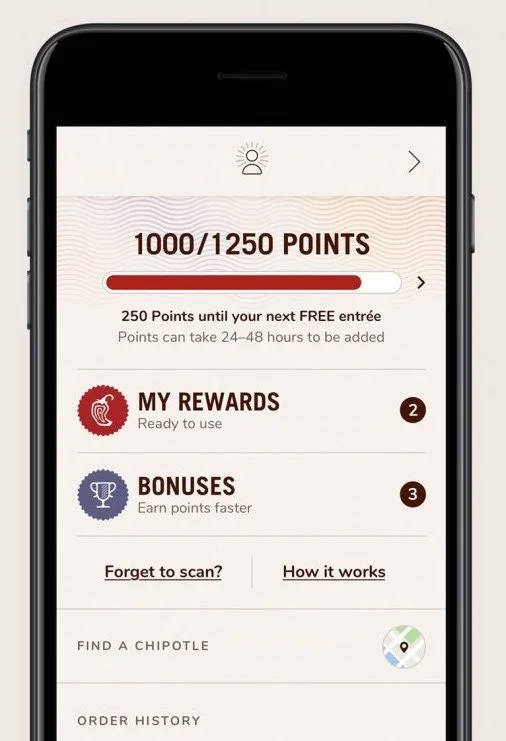

Commonly cited as the best mobile Rewards program, Starbucks’ mobile app functions as both a rewards program and a payment method, all in one. Starbucks stars are famously known; spending $1 in Starbucks gets you 1 star, which you can convert into a free drink. CPG rewards get fancy, incentivizing customers with rewards points by sharing things on social media, leaving reviews, and taking certain actions at checkout. Chipotle recently launched its Rewards Exchange, which allows customers to redeem points and trade them for free food, free merch, or even free donations. Chick-fil-A is a notoriously loved Rewards program as well, offering customers different tiers of rewards by how much they buy.

These programs work because these companies operate their own digital economies; they have truly built a fully integrated network allowing you to trade goods, within their apps. And today, nearly every modern company has a rewards program. From fashion brands to hotels to cafes to products, brands have all found ways to reward loyalty through points, tokens, coins, or stars. And that has stayed consistent throughout history from copper tokens to S&H Green Stamps to Boxtops to Starbucks Stars. Now, where can it go?

Rewards as identification

First, it’s also important to understand how personal Rewards have become. Logging into your rewards profile with Starbucks, Chipotle, or Sephora you’ll find a custom wallet, built through your previous transactions.

Here’s a peek at a Chipotle rewards profile…

Because these companies require us to make accounts and link our purchases to those accounts, every interaction we have through them is traced - and rewarded- through the app or online ecosystem.

What this is, in the big picture, is a unique identifier, a brand-specific address linked to you and only you. It’s your wallet, your account. For now, it’s still specific to a brand. This is your Chipotle-Metamask wallet. But what if that changed? If we could use blockchain to evolve separate rewards accounts, what could that look like?

Rewards as tokens: Tinder

Rewards programs are starting to get more creative, more experimentative, and more forward-facing. At Tinder, they recently launched Tinder Coins, an in-app currency redeemable for super likes, boosts, and with plans to trade them in for virtual goods (like sending a match a virtual rose). These coins can also be earned in-app through regular use, or purchased (ofc). Perhaps these coins could be earned and traded for participating in events like Swipe Night, or for meeting up in person and verifying it through a selfie?

Now, let’s take that one step further.

Rewards as currency: Starbucks

On a recent earnings call, Starbucks CEO Kevin Johnson revealed a peek into the evolution of their rewards program that was responsible for 51% of US tender in company-operated stores from Q4 of 2021:

“We continue to nurture and deepen our direct personalized digital relationship with our members with enhancements to the program like Stars for Everyone to expand reach and through payment partnerships with PayPal and Bakkt, where a customer can now reload their Starbucks card with a range of cryptocurrencies including Bitcoin, Ethereum and others by converting digital currencies to physical currency and reloading their Starbucks card,” Johnson said on the recent earnings call.”

He goes on to reveal what we find to be the most fascinating element of it all:

“Through blockchain or other innovative technologies, we are exploring how to tokenize Stars and create the ability for other merchants to connect their rewards program to Starbucks Rewards. This will enable customers to exchange value across brands, engage in more personalized experiences, enhance digital service and exchange other loyalty points for stars at Starbucks”.

In March of 2021, Starbucks began experimenting with partnerships. Air Canada began to offer members a chance to link their Aeroplan to their Starbucks Rewards accounts, allowing members to get Aeroplan points when they make purchases at Starbucks.

Johnson also mentioned that within the next year, consumers would see this type of exchange with another consumer brand and that this approach is serving as a foundation for “new, modern payment rails that align payment expenses with the value received by customers and merchants.”

Rewards interoperability

The idea that Starbucks introduces here is not a new concept, but certainly, one that is new as a Rewards use case. At scale, this is interoperability. Recall our previous piece on brand’s bridges to the metaverse; ways brands can onboard users into this digital future, at scale and in authentic ways that are true to the brand.

Imagine this; you trade your airline points to a friend who only needs a few more points to book their flight. They trade you their Chipotle rewards points because you’re hungry and want something quick and tasty. After your purchase, you chose to exchange your freshly earned points from that guac-heavy bowl into Sephora points so you can get your partner a nice makeup set for Christmas. These exchanges could happen within those program’s apps, or they could happen in third-party platforms like Roblox, Fortnite, or even via Snapchat.

This concept (at scale) becomes a virtual currency exchange, one no different than trading Bitcoin for Ethereum or USD for Euros. Companies like CashApp and Venmo are already tip-toeing lines between social and DeFi, with Venmo now allowing users to buy cryptocurrency through the app, and with CashApp allowing users to send stocks and bitcoin. These apps align with a bigger shift in a generational mentality away from centralized power and into decentralization.

To now re-examine Rewards programs through this lens, we see how interchangeable rewards can perhaps be the path to this increasingly social yet decentralized world. We see how it may be a path to interoperability: a path where building the value of a brand could build the value of its currency. A future where stock prices would no longer be the true indicator of value because when everyone is trading their airlines and their Sephora points for Chipotle or for Tinder coins, the latter become inherently more valuable. A future led by demand for the product and fueled by brand loyalty. And that, at its core, would be the truest sign of a brand’s value to the consumer. A company’s “stock” price would no longer be as valuable as the value of its currency. And that value would not be manipulated or bought; it would only be shifted by true consumer demand, one exchange at a time, from one friend to another.